Use Notion to plan and track personal finances by creating custom budget templates and tracking dashboards. Embed financial goals, expenses, and savings plans to monitor spending habits and saving progress.

Effectively managing personal finances requires both organization and adaptability, two areas where Notion excels. Notion’s versatile platform allows individuals to design a personalized financial system that can house various types of data in one seamless interface. By using templates for budgeting and expense tracking, users can achieve a clear overview of their financial health.

Customizable tables, databases, and reminders in Notion make it simple to stay on top of bills, set financial goals, and monitor investments, all from a central location. Regularly updating entries helps maintain financial clarity and can lead to improved spending habits and better decision-making. With real-time data visualization, Notion users can quickly assess their financial standing, ensuring they meet their personal finance objectives efficiently.

Credit: www.framer.com

The Rise Of Notion As A Planning Powerhouse

Notion has exploded onto the scene, quickly becoming a go-to app for organizing every aspect of life. What began as a sleek note-taking platform has evolved. It now stands out as an indispensable tool for users looking to track and manage their personal finances. With its diverse array of features and infinite customizability, Notion adapts to each individual’s financial planning needs.

From Note-taking To Financial Mastery

Many users discovered Notion’s potential for simple note-taking. Its versatility was soon recognized. The app’s capabilities stretch far beyond basic notes. Users create detailed financial plans, track expenses, and set budget goals. All with the same ease as jotting down a grocery list. With Notion, anyone can master their finances, turning numbers and goals into visual, manageable entities.

- Create Budgets: Visualize monthly spending.

- Track Expenses: Log purchases with date and category.

- Set Goals: Plan for big expenses like vacations or a new car.

Cross-platform Functionality For User Convenience

Notion shines with its ability to sync across devices. Whether on a phone, tablet, or laptop, Notion ensures that financial information is accessible anywhere. This convenience means real-time updates to budgets. It means tracking expenses on the go. A seamless digital finance assistant fits right in the pocket.

| Device | Accessibility |

|---|---|

| Phone | Manage finances anytime. |

| Tablet | Large view for detailed planning. |

| Laptop | Comprehensive analysis and adjustments. |

In Notion, the possibilities are endless. Plan personal finances with precision and ease. Embrace the multi-device sync to stay on top of every penny, everywhere.

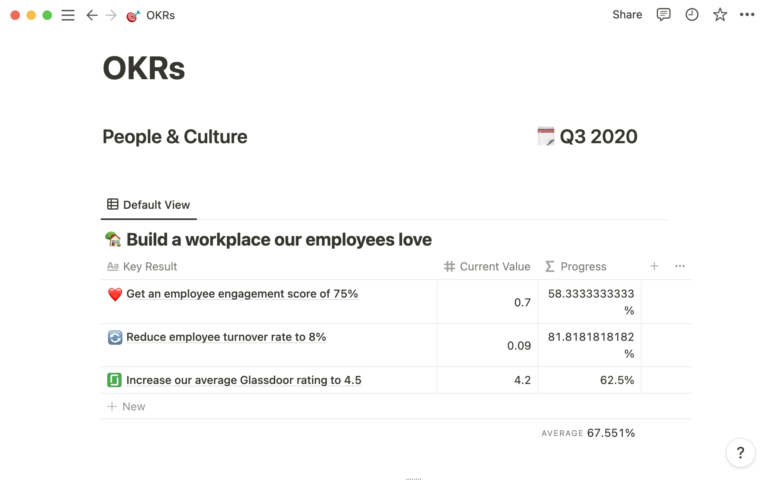

Credit: www.notion.so

Customization: Tailoring Notion For Your Finances

Personal finance management can seem daunting. Notion comes to the rescue with its powerful customization features. Users can design a system that fits their financial behavior and goals perfectly. Let’s dive into how you can create templates for budgets and track expenses. We will also cover managing investments with personalized dashboards in Notion.

Creating Templates For Budgets And Expenses

Setting up a budget is key for financial health. Notion’s template feature lets you build a custom budget tracker. Begin by outlining categories for income and expenses.

- Design a monthly budget layout.

- List income sources.

- Detail fixed and variable expenses.

Include a section for notes to monitor changes in spending habits. Use Notion’s table properties to organize data effectively. Tables keep information clear and accessible.

| Date | Description | Category | Amount |

|---|---|---|---|

| April 5 | Groceries | Food | $150 |

| April 10 | Internet Bill | Utilities | $60 |

Automate calculations for immediate insight. Use formulas within your table to sum expenses. This way, you always know if you are within budget.

Tracking Investments With Personalized Dashboards

Investment tracking requires attention to detail. In Notion, craft a dashboard that reflects your portfolio. Include stocks, bonds, retirement accounts, and other assets.

- Set up a new page for your Investment Dashboard.

- Add properties for asset names, types, values, and growth.

- View data through different lenses with linked databases for a comprehensive look.

Monitor performance over time. Graphs and charts can be inserted to visualize growth. Notice trends at a glance. Update your dashboard regularly to capture the latest market changes.

Collaboration Features In Financial Management

Managing personal finances gets easier with Notion’s collaboration features. These tools help you work with others on the same page.

Real-time Updates With Team Members Or Advisors

Working together on finances means staying up-to-date. Notion makes this simple. Imagine tweaking a shared budget and everyone sees changes immediately. This works great for team projects or with financial advisors. You both can view and edit financial plans in real-time.

Benefits include:

- Instant communication: Chat about changes as they happen.

- Live editing: See updates instantly without refreshing pages.

- Version history: Track who made what changes and when.

Shared Access For Family Budgeting

Notion excels in family finance management. Grant access to family members so everyone can contribute. Set budgets, track expenses, and plan savings together.

How to set up shared family budgeting:

- Create a new Notion page labeled ‘Family Budget’.

- Add a table with columns for income, expenses, and savings.

- Invite family members via email.

- Assign roles and permissions for editing or viewing.

| Member | Role | Permissions |

|---|---|---|

| Parent 1 | Editor | Can edit and comment |

| Parent 2 | Editor | Can edit and comment |

| Child | Viewer | Can view and comment |

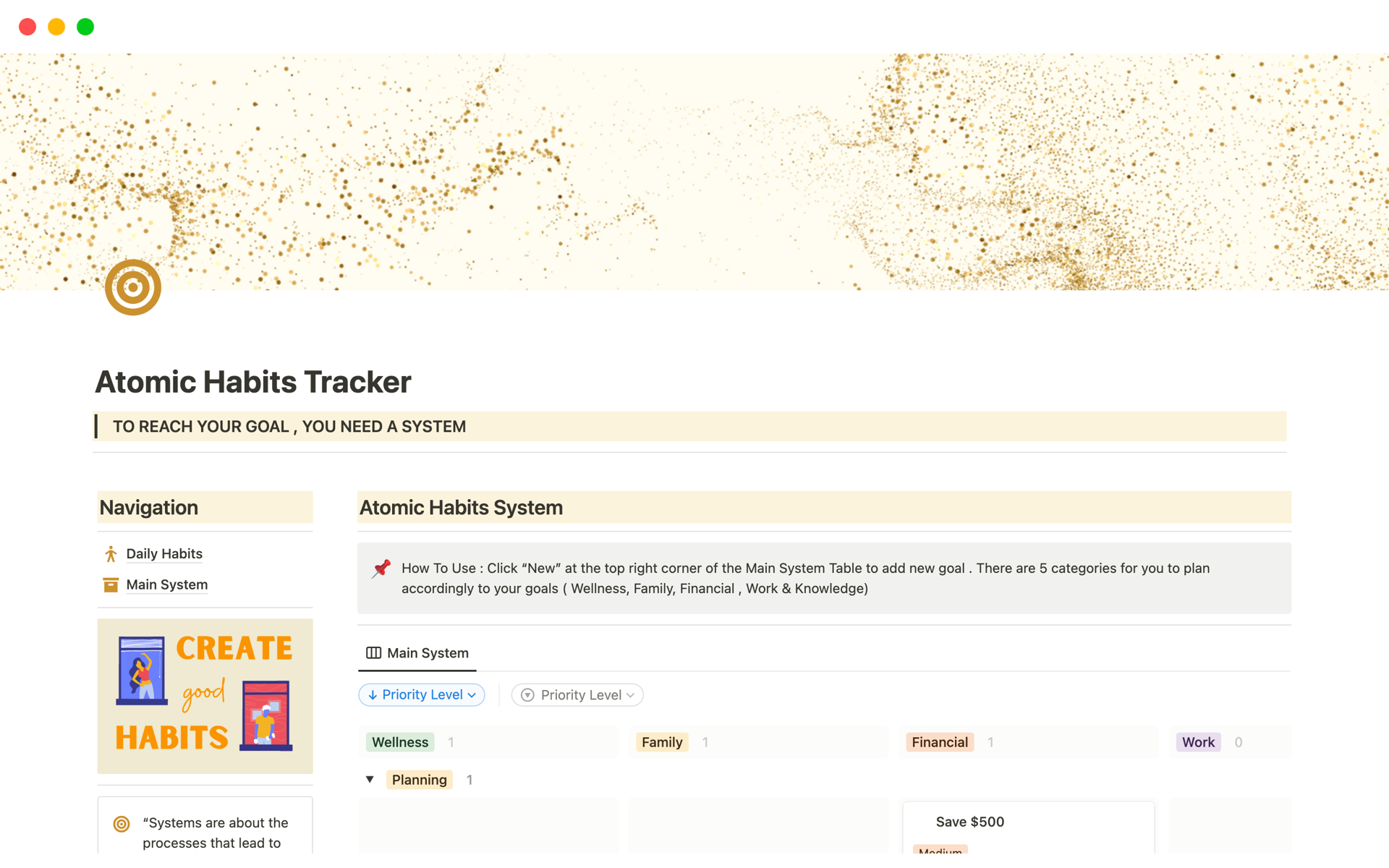

Automation For Efficiency And Accuracy

Managing personal finances can often feel overwhelming. Notion simplifies this process through automation. Automation helps maintain efficiency and accuracy in financial planning. It ensures that nothing slips through the cracks. Users can automate reminders for bills, track expenses, and even integrate with other financial tools.

Recurring Expenses And Automated Reminders

Never miss a payment with Notion’s automated reminders. Users can set up their Notion workspace to keep track of monthly bills and subscriptions.

- Set it and forget it: Enter recurring expenses and their due dates once.

- Let Notion remind you: The platform sends notifications before each due date.

This level of automation removes the need to manually track each payment, saving time and preventing late fees.

Integrating Tools And Plugins For Advanced Functions

Expand Notion’s capabilities by integrating other financial tools and plugins. This provides advanced functions tailored to your financial needs.

- Connect plugins: Link tools like budget trackers or investment monitors.

- Import data automatically: Have all your financial information in one place.

- Customize workflows: Design the system that best fits your personal finance goals.

With these integrations, Notion acts as a central hub for all your finance-related tasks.

Notion’s Security Measures For Your Financial Data

When managing personal finances, security is a top priority. Notion understands this and implements robust security measures. These measures help keep financial data safe and private. This way, users can plan and track their finances effectively.

Encryption Standards to Protect Sensitive InformationEncryption Standards To Protect Sensitive Information

Notion employs industry-standard encryption techniques to safeguard data. This approach ensures that sensitive financial information remains protected. Both in transit and at rest, your data is encrypted using strong protocols. With Notion, you can rest easy knowing your financial details are secure.

Backup and Recovery OptionsBackup And Recovery Options

Data loss can be a nightmare, especially with financial information. Notion mitigates this risk by providing backup and recovery options. Users have the power to recover from unintended deletions. This creates a fail-safe environment for financial planning and tracking.

- Automatic cloud backups keep your data safe.

- Manual backup options are also available for additional control.

- Easy data restoration keeps your financial plan on track.

Credit: www.sincode.ai

Case Studies: Success Stories Of Financial Planning With Notion

Notion, the versatile organization tool, has become a game-changer for many. Users have transformed their financial life. Read these real-world stories.

Individuals Finding Financial Clarity

Meet Emily, a freelancer who struggled with scattered finances. Stacks of receipts and unclear income patterns were her norm.

- Created custom finance tracker

- Logged income streams and expenses

- Set financial goals

Notion became her financial dashboard. She now enjoys peace of mind and clear financial goals.

| Before Notion | After Notion |

|---|---|

| Unorganized finances | Structured finance tracking |

| Unclear goals | Clean financial objectives |

Businesses Streamlining Budgeting Processes

Small business owner, Alex, faced budgeting nightmares. His company lacked a unified budget plan.

- Developed a Notion budget template

- Integrated team inputs seamlessly

- Tracked real-time spending

The outcome? Alex’s business now has a centralized budgeting system. Smart financial decisions are now possible.

Frequently Asked Questions Of How Can I Use Notion To Plan And Track My Personal Finances Effectively?

What Is The Best Way To Keep Track Of Personal Finances?

The best way to manage personal finances is by creating a budget, tracking expenses, setting financial goals, reviewing statements regularly, and using finance apps or tools for assistance.

How Do I Organize My Personal Finances?

Begin by creating a budget to track income and expenses. Prioritize saving by establishing an emergency fund. Reduce debt strategically, starting with high-interest liabilities. Invest wisely for long-term growth. Review and adjust your financial plan regularly for optimal management.

How Do You Create A Financial Tracker?

To create a financial tracker, choose a method like a spreadsheet or an app. Record all income sources and expenses. Set financial goals and monitor them regularly. Update the tracker consistently to maintain accuracy and make informed budgeting decisions.

How Do You Do Personal Financial Planning?

Start by assessing your current financial situation. Next, set realistic short and long-term financial goals. Create a budget to manage expenses. Save regularly for emergencies and retirement. Review and adjust your plan periodically to stay on track.

Conclusion

Embracing Notion for personal finance management is a smart move. With its flexible features, you can visualize your expenses, set goals, and monitor progress. Remember, consistency is key to benefit from Notion’s organizational perks. Start small, refine your system, and watch your financial health flourish.

Ready to take control? Notion awaits.